how to avoid paying nanny tax

Ad Will Handle All Of Your Nanny Payroll and Tax Obligations. This way there are no surprises on the first payday.

What Is The Nanny Tax And Am I Required To Pay It

Nanny Household Tax and Payroll Service.

. Pay your every other week maids no more than 5765 per home. Failure to pay the Nanny Tax has resulted in numerous high-profile scandals involving political appointees of every US. Full service and tax only.

Pay your weekly maid no more than 2883 per house cleaning. Subtract Social Security and. This ongoing parade of Nannygate.

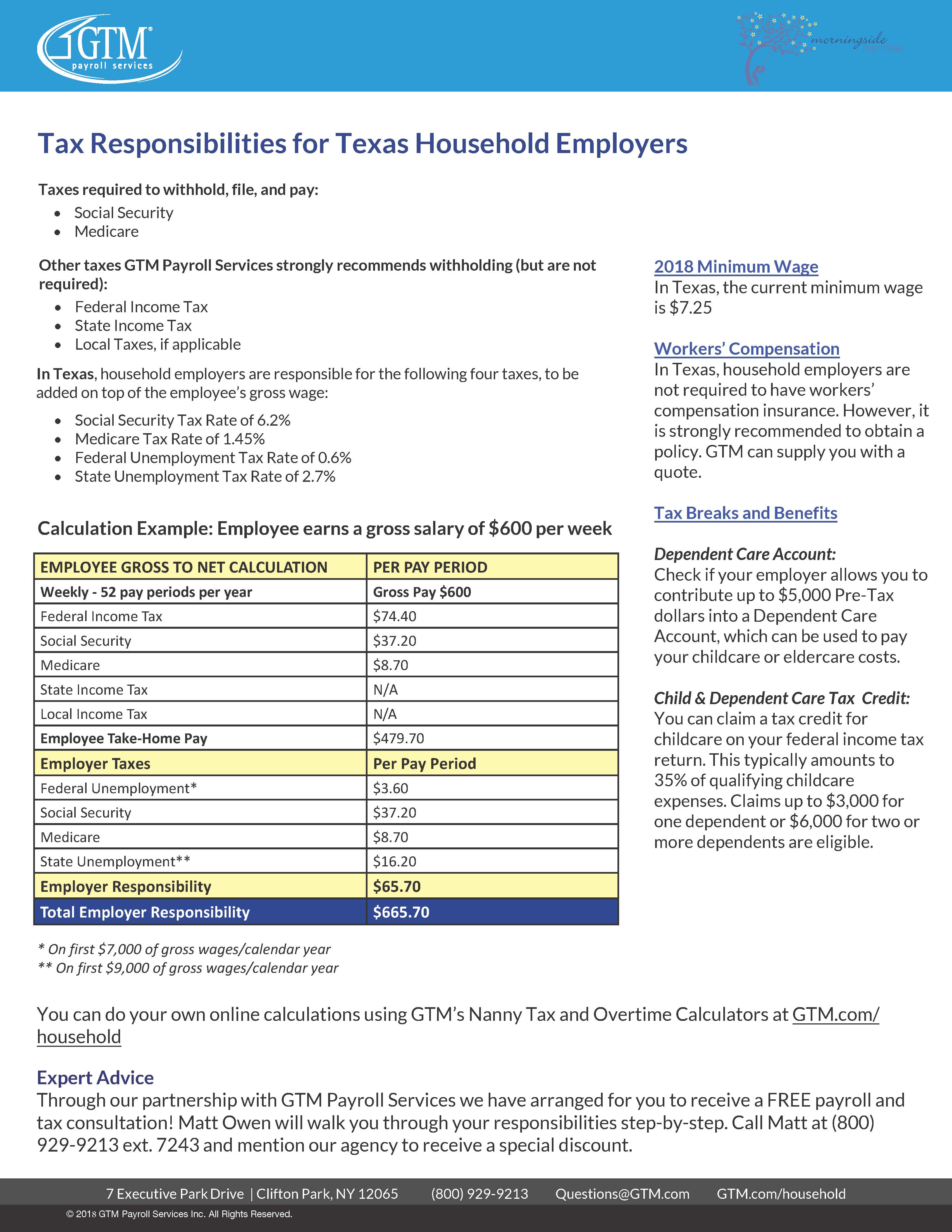

When you pay your nanny she is legally treated like the professional she is and promotes her future financial. Household employees are liable for four key taxes. Ad Ideal For Busy Families and Budgets.

To break this down further you and your employee are each responsible for. No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. Instead of paying your caregiver via company payroll and taking a business tax deduction you should pay them through your.

Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live. These exist if your nanny is. Pay your weekly maid no more than 2883 per house cleaning.

Assuming your nanny is indeed an employee and not an independent contractor you dont have to pay a nanny tax if theyre. Pay Your Nannys Salary Tally your nannys hours multiply it by their hourly rate and add overtime pay to get the gross pre-tax amount you owe. Easy Tax Preparation Management.

Pay your every other week maids no more than 5765 per home cleaning. Pay your every other week maids no more than 5765 per home cleaning. Nanny Tax Exceptions.

You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return. If the parents pay the nanny wages of 1000 or more in any calendar quarter they also need to pay federal unemployment tax on the first 7000 of wages. Your spouse Your child whos under age 21 A minor.

You need to keep the two payrolls separate. Nanny Household Tax and Payroll Service. For 2020 this credit can reduce the cost of child care expenses from hiring a nanny and can be worth as much as 20 to 35 of up to 3000 of child care or similar costs.

There are some exceptions to paying a nanny tax even if your nanny is an employee and not an independent contractor. FICA taxes are 153 of the employees wages. The Social Security Administration requires you to file Form W-3 and.

Easy Tax Preparation Management. Tips to avoid the Nanny Tax. Heres what can happen and best practices to avoid these issues.

At the start of their employment inform your nanny of her payroll tax obligations. Since you dont pay nanny taxes including unemployment taxes you can expect a call from your state with failure-to-pay and failure-to-file penalties which can add up to 50. No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence.

NannyChex is an online service that has two levels of service. Nanny taxes are relatively simple to calculate. How can I avoid paying nanny taxes.

Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live. President from Clinton to Trump. Ad Ideal For Busy Families and Budgets.

Tips to avoid the Nanny Tax. With full service all you have to do is go in and approve your payroll each pay period. Pay your weekly maid no more than 2883 per house cleaning.

Ad Will Handle All Of Your Nanny Payroll and Tax Obligations.

Nanny Household Employment Tax Who Owes It Taxact

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

6 Household Employment Mistakes And How To Avoid Them Care Com Homepay

Nanny Tax Overview Requirements Exemptions

Tax Reminders Archives Page 2 Of 2 Nannypay

Nanny Tax Do I Have To Pay It Credit Karma Tax

How To Keep Your Nanny Tax Clients Happy Cpa Practice Advisor

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

The Abcs Of Household Payroll Nanny Taxes Cpa Practice Advisor

2018 Nanny Tax Responsibilities

How Does The Nanny Tax Impact The Employer And Employee

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

The Differences Between A Nanny And A Babysitter

We Hired A Nanny Now What About The Taxes Accredited Investors